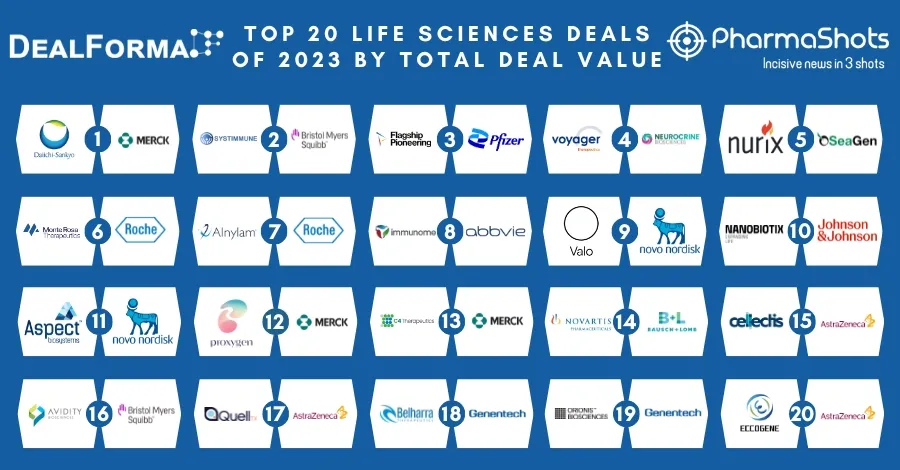

Top 20 Biopharma M&A of 2023 by Total Deal Value

Shots:

- With stringent antitrust regulation clasping the overall volume of M&A deals, the biopharma industry manages to hold up a few strong M&A while conquering the waves of unexpected economic turmoil in 2023

- In 2023, the global biopharma industry witnessed an astounding transformation with M&A deals. Pfizer’s acquisition of Seagen for $43B ranks first in our report, followed by BMS’ acquisition of Karuna Therapeutics for $14B and Merck & Co’s acquisition of Prometheus Biosciences for $10.8B

- With the invaluable insights from DealForma, PharmaShots brings an enlightening report on Top 20 Biopharma M&A of 2022 based on Total Deal Value

Check out our Dealmaker of the Year analysis with Pfizer & Roche leading the deal-making based on the number of deals and total deal value

20. Eli Lilly and POINT Biopharma

Deal Date: Oct 3, 2023

Deal Value: $1.4B

- Eli Lilly signed a definitive agreement to acquire POINT Biopharma in Oct 2023. This deal shows Lilly’s increased focus on Oncology segment by acquiring POINT Biopharma for its Radioligand Therapies

- The acquisition led Eli Lilly to gain rights to POINT’s lead assets including:

- P-III PNT-2002 for Metastatic Castration-Resistant Prostate Cancer (mCRPC) and PNT-2003 for Neuroendocrine Tumors (NETs)

- P-I PNT-2004 for Solid Tumors

- Preclinical PNT-2001 for Prostate Cancer

- As per the agreement, POINT’s stakeholders will receive $12.5/share of POINT’s common stock in cash at an 87% one-day premium for an aggregate of $1.4B. After extending the tender offer 5 times, Eli Lilly completed the acquisition of POINT Biopharma on Dec 27, 2023

19. Chiesi and AMRYT Pharma

Deal Date: Jan 8, 2023

Deal Value: $1.5B

- In Jan 2023, Chiesi signed a definitive agreement to acquire Amryt Pharma. This acquisition can be seen as further steps to enforce Chiesi’s presence and portfolio in rare diseases

- Amryt’s lead assets that became a part of Chiesi’s pipeline were:

- Approved Juxtapid (Lojuxta) for Homozygous Familial Hypercholesterolaemia (HoFH)

- Approved Myalept (Myalepta) for Lipodystrophy,

- Approved Mycapssa (octreotide) for Acromegaly

- Approved Filsuvez (Oleogel-S10) for Epidermolysis Bullosa

- Preclinical AP-103 for skin diseases (likely Epidermolysis bullosa dystrophica)

- Under the terms of the agreement, Amryt stakeholders will received an upfront cash payment of $1.25B in exchange for Amryt's ADSs (each equivalent to 5 Amryt ordinary shares) at $14.50 per ADSs (or $2.90 per ordinary share) at a 107% one-day premium whereas Amryt was also eligible for up to $2.50 in CVRs per ADS (or up to $0.5 per ordinary share) including $1.00 upon Filsuvez’s FDA approval and $1.50 for the FDA Priority Review Voucher for an aggregate of $225M. Chiesi Farmaceutici completed the acquisition of Amryt Pharma on Apr 12, 2023

18. SOBI and CTI Biopharma

Deal Date: May 10, 2023

Deal Value: $1.7B

- In May 2023, Swedish Orphan Biovitrum (SOBI) entered into a definitive agreement to acquire CTI Biopharma. The acquisition was made to complement and strengthen SOBI’s Haematology pipeline

- CTI BioPharma’s lead asset Vonjo (Pacritinib), which received the US FDA’s accelerated approval for the treatment of Myelofibrosis, was added to SOBI’s pipeline through the acquisition

- Under the terms of the agreement, CTI BioPharma’s shareholders will receive $9.10 per share in cash at an 89% one-day premium for an aggregate of $1.7B. Later, on June 24, 2023, SOBI completed the acquisition of CTI BioPharma

17. AstraZeneca and CinCor Pharma

Deal Date: Jan 9, 2023

Deal Value: $1.8B

- AstraZeneca reported the acquisition of CinCor Pharma in Jun 2023. The acquisition was made by AstraZeneca as a step to enhance its cardiorenal pipeline through CinCor’s lead assets

- Baxdrostat (CIN-107), an aldosterone synthase inhibitor (ASI) developed for blood pressure lowering in treatment-resistant hypertension, is Cincor’s lead asset

- As per the terms of the agreement, CinCor’s stakeholders will receive an upfront cash payment of $1.3B in exchange for CinCor’s outstanding share at $26 per share at a 121% one-day premium whereas CinCor is also eligible for a non-tradable CVR of up to $10 per share in cash upon Baxdrostat regulatory submission summing up to $500M. AstraZeneca on Feb 24, 2023, completed the acquisition of CinCor Pharma

16. Eli Lilly and Versanis

16. Eli Lilly and Versanis

Deal Date: Apr 18, 2023

Deal Value: $1.92B

- In Apr 2023, Eli Lilly entered into a definitive agreement to acquire Versanis. This acquisition marks the step taken by Lilly to further strong their existing dominance in Cardiometabolic Diseases

- Versanis’ lead assets include a monoclonal antibody, Bimagrumab, that is currently being evaluated in a P-II (BELIEVE) clinical study for the treatment of overweight or obese adults

- Following the terms of the agreement, Versanis was eligible to receive a payment of $1.925B as up front, development, and commercial milestones. Eli Lilly completed the acquisition of Versanis Bio on Aug 14, 2023

15. GSK and Bellus Health

Deal Date: Apr 18, 2023

Deal Value: $2B

- GSK reported the acquisition of Bellus Health to strengthen its specialty medicine and respiratory pipeline in Apr 2023. Through the acquisition, GSK gained the rights to Camlipixant (BLU-5937), Bellus’ lead asset.

- Camlipixant (BLU-5937) is a highly selective P2X3 antagonist being evaluated in a P-III clinical trial for the treatment of adults with Refractory Chronic Cough (RCC)

- Under the terms of the agreement, Bellus’ stakeholders received $14.75 per share of Bellus’ common stock in cash for a total equity value of $2B. Later, on Jun 28, 2023, GSK completed the acquisition of Bellus Health

14. Eli Lilly and DICE Therapeutics

14. Eli Lilly and DICE Therapeutics

Deal Date: Jun 20, 2023

Deal Value: $2.4B

- In Jun 2023, Eli Lilly signed a definitive agreement to acquire DICE Therapeutics as a step to enhance its position in the Immunology sector. The acquisition allows Eli Lilly to gain the rights to DICE’s lead assets including:

- P-II DC–806 (Psoriasis, Autoimmune & Inflammatory diseases) & P-I DC–853 (Psoriasis, Autoimmune & Inflammatory diseases) as fast-follower of DC-806

- Preclinical Novel Scaffold Therapy for the treatment of Psoriasis, Integrin based therapies like Oral α4β7 for IBD, Oral αVβX for Fibrosis, Oral PD-L1 for Immuno-Oncology Diseases, and various research staged molecules developed using DELSCAPE Technology Platform

- As per the terms of the agreement, DICE’s stakeholders received $48 per share in cash at a 42% one-day premium for an aggregate of $2.4B up front

- Later in Jul 2023, Eli Lilly extended the tender offer for its acquisition of DICE Therapeutics which was then completed on Aug 9, 2023

13. Sanofi and Provention Bio

Deal Date: Mar 13, 2023

Deal Value: $2.9B

- Sanofi to acquire Provention Bio in an all-cash transaction. The acquisition adds therapies for Type-1 Diabetes into Sanofi’s portfolio of General Medicine

- Provention Bio's lead assets include:

- Tzield for the treatment of Type 1 Diabetes

- P-II PRV-3279, developed for the treatment of Systemic Lupus Erythematosus (SLE)

- Ordesekimab for Celiac Disease

- P-I PRV-101

- Preclinical PRV-3279 for Systemic Lupus Erythematosus (SLE)

- As per the terms of the agreement, Provention’s stakeholders received $25 per share in cash for the shares not already owned by Sanofi for a total equity consideration of $2.9B. Sanofi completed the acquisition of Provention Bio on April 27, 2023

12. Roche and CARMOT Therapeutics

12. Roche and CARMOT Therapeutics

Deal Date: Dec 3, 2023

Deal Value: $3.1B

- In Dec 2023, Roche reported the acquisition of Carmot as a move to enhance its pipeline in Metabolic Diseases. The acquisition allows Roche to gain rights to Carmot’s pipeline for Obesity and Diabetes

- Carmot’s lead assets gained by Roche through the acquisition include:

- P-II CT-388, developed for the treatment of Obesity with or without Type 2 Diabetes

- P-II GLP-1/GIP receptor agonist

- P-II CT-868, a subcutaneous injectable for Type 1 Diabetes

- P-I CT-996, a small molecule GLP-1 receptor agonist, being developed for the treatment of Obesity

- Preclinical CT-PYY, a long-acting PYY analogue

- As per the terms of the agreement, Carmot’s shareholders will receive an up front payment of $2.7B and are also eligible for up to $400M in milestone payments. The transaction is expected to close by the first quarter of 2024

11. Novartis Pharmaceuticals and CHINOOK Therapeutics

Deal Date: Jun 12, 2023

Deal Value: $3.5B

- Novartis entered into an agreement to acquire Chinook in Jun 2023. The acquisition was made by Novartis to enhance its Renal Portfolio and gaining the rights to Chinook’s lead assets

- Chinook has a broad pipeline of products with lead assets including:

- P-III Atrasentan, being developed for the treatment of IgA Nephropathy and Segmental Glomerulosclerosis

- P-II BION-1301 for the treatment of IgA Nephropathy

- P-I CHK-336 for Primary and Idiopathic Hyperoxalurias

- Other preclinical and research-staged therapies for the treatment of Rare Kidney Diseases

- Chinook’s stakeholders received an aggregate of $3.2B, for each share of Chinook’s common stock at $40 per share in cash for a 67% one-day premium and are also eligible to receive up to $300M in a regulatory milestone at $4 per share including $2 upon approval of Atrasentan for IgA Nephropathy and an additional $2.00 for focal segmental Glomerulosclerosis respectively. The acquisition of Chinook was completed by Novartis on Aug 11, 2023

10. BMS and RayzeBio

Deal Date: Dec 26, 2023

Deal Value: $4.1B

- In Dec 2023, BMS reported the acquisition of RayzeBio as a move to enhance its Oncology portfolio with the addition of RayzeBio’s lead assets

- RayzeBio develops a series of Radiopharmaceutical Therapeutics through its actinium-based radiopharmaceutical platform and its lead assets include:

- P-III RYZ101 (225Ac-DOTATATE), which targets SSTR2, overexpressed in Gastroenteropancreatic Neuroendocrine Tumors (GEP-NETs) And Extensive Stage Small Cell Lung Cancer (ES-SCLC)

- Preclinical RYZ801, a proprietary peptide targeting glypican-3 (GPC3) for the delivery of actinium-based radioactivity to treat Hepatocellular Carcinoma (HCC)

- An additional preclinical product that targets CA9, expressed in Renal Cell Cancer

- As per the agreement, BMS will acquire all outstanding shares of RayzeBio common stock at $62.5 per share in an all-cash transaction, adding to an equity value of $4.1B ($3.6B net of estimated cash acquired). The transaction is expected to close by the first half of 2024

9. BMS and MIRATI Therapeutics

Deal Date: Oct 08, 2023

Deal Value: $5.8B

- In Oct 2023, BMS reported the acquisition of Mirati to strengthen and diversify its Oncology portfolio. The acquisition allows BMS to gain the rights to Mirati’s assets, which include:

- Krazati, a KRASG12C inhibitor approved by the US FDA for the treatment of Non-Small Cell Lung Cancer

- A combination of Krazati and PD-1 inhibitor is also being developed by Mirati for patients with Non-Small Cell Lung Cancer

- MRTX-1719, MRTX-1133, and MRTX-0902 are under Mirati’s pipeline

- As per the terms of the agreement, Mirati’s stakeholders will receive $58 per share at a 52% one-day premium for an aggregate of $4.8B equity value or a $3.7B enterprise value along with $1.1B in cash

- Moreover, each of Mirati’s shareholders will also receive 1 non-tradeable CVR of $12 per Mirati share value at up to $1B upon the US FDA’s acceptance of NDA for MRTX-1719. The transaction is expected to close by the first half of 2024

8. Astellas and IVERIC BIO

Deal Date: Apr 30, 2023

Deal Value: $5.93B

- Astellas reported the acquisition of Iveric Bio in Apr 2023. The acquisition of Iveric Bio allows Astellas to gain Iveric’s expertise in R&D of innovative therapeutics and Ophthalmology

- Moreover, through the acquisition, Astellas has gained the rights to Iveric’s lead assets, including:

- P-III Avacincaptad Pegol, being developed for the treatment of Dry and Wet Age-Related Macular Degeneration

- Preclinical IC-500 for the treatment of Brain Injuries and mini-CEP290 for Leber Congenital Amaurosis

- A research stage mini-ABCA4 for the treatment of Stargardt Disease and mini-USH2A for Usher Syndrome

- Inveric received an aggregate of $5.9B in total equity value, representing 148.2M shares of its common stock for $40 per share in cash at a 22% one-day premium. Astellas completed the acquisition of Iveric Bio on Jul 11, 2023

7. Roche and Telavant

Deal Date: Oct 23, 2023

Deal Value: $7.25B

- Roche reported the acquisition of Telavant, a part of Roivant Sciences through a definitive merger agreement in Oct 2023. The acquisition of Telavant was made by Roche to enhance its portfolio by the addition of Telavant’s lead assets in Inflammatory Bowel Disease. Telavant’s key assets are:

- P-III RVT-3101, being developed for the treatment of Ulcerative Colitis and Crohn’s Disease

- P-I undisclosed anti-TL1A therapy for the treatment of Inflammatory Diseases

- Telavant received a $7.1B up front payment and is eligible to receive up to $150M as near-term milestones payments. As 25% of Telavant is already owned by Pfizer, Roche will be responsible for the development and commercialization of RVT-3101 across the US and Japan whereas Pfizer retains the commercialization right for RVT-3101 across the rest of the world

- Additionally, Roche also has the option to collaborate with Pfizer to develop a p40/TL1A-directed bispecific antibody. On Dec 14, 2023, Roche completed the acquisition of Telavant

6. Biogen and Reata Pharmaceuticals

Deal Date: Jul 28, 2023

Deal Value: $7.54B

- In Jul 2023, Biogen signed a merger agreement to acquire Reata Pharmaceuticals. Reata has a pipeline of products that regulate cellular metabolism and inflammation in serious neurologic diseases. The acquisition was made to enhance Biogen’s Neurology and Rare Disease portfolio through Reata’s lead assets, including:

- Skyclarys, approved for the treatment of Friedreich’s Ataxia, Ocular Inflammation & Pain

- P-I Cemdomespib in clinical development for the treatment of Diabetic Neuropathies

- Preclinical RTA-415 & RTA-417, Nrf2 activators for the treatment of other Neurologic Diseases

- By the terms of the agreement, Reata’s stakeholder would receive $172.5 per share of Reata’s common stock at a 60% one-day premium for an enterprise value of $7.3B

- Moreover, Biogen later reported that Reata’s shareholders received $6.6B in cash for an exchange of shares along with an additional $983.9M in equity awards, including employer taxes and post-acquisition services. Biogen completed the acquisition of Reata Pharmaceuticals on Sep 26, 2023

5. AbbVie and Cerevel

Deal Date: Dec 6, 2023

Deal Value: $8.7B

- AbbVie signed a definitive merger agreement to acquire Cerevel for its neuroscience pipeline of multiple clinical-stage and preclinical assets for Schizophrenia, Parkinson’s Disease, and Mood Disorders

- The acquisition enhances AbbVie’s neuroscience portfolio by the addition of Cerevel’s lead assets including

- P-II Emraclidine, a positive allosteric modulator of the muscarinic M4 receptor, being developed for Schizophrenia and dementia-related psychosis in Alzheimer's Disease and Parkinson’s Disease. Additionally, Emraclidine was also evaluated in a P-I trial for Alzheimer's Disease in elderly patients

- P-III Tavapadon, a dopamine D1/D5 selective partial agonist for the management of Parkinson’s Disease

- P-I CVL-354, a kappa opioid receptor antagonist being developed for Major Depressive Disorder

- P-II Darigabat, an alpha 2/3/5 selective GABAA receptor PAM being developed for treatment-resistant Epilepsy and Panic Disorder

- As per the terms of the acquisition, AbbVie will acquire all outstanding shares of Cerevel for $45 per share in cash at a 22% premium for a total equity value of $8.7B. The transaction is expected to close by mid-2024

4. AbbVie and ImmunoGen

Deal Date: Nov 30, 2023

Deal Value: $10.1B

- AbbVie signed a merger agreement to acquire ImmunoGen in Nov 2023 as a move to accelerate AbbVie’s commercial and clinical presence in the treatment of solid tumors

- As part of the acquisition ImmunoGen’s lead assets including Elahere, an ADC approved for the treatment of platinum-resistant ovarian cancer will become a part of AbbVie’s portfolio. Other than Elahere, ImmunoGen’s pipeline also includes pivekimab sunirine, IMGC-936, and IMGN-151

- Under the terms of the agreement, ImmunoGen’s stakeholders will receive $31.26 per share in cash at a 95% one-day premium for a total of $10.1B equity value. The transaction is expected to close by mid-2024

3. Merck and Prometheus Biosciences

Deal Date: Apr 16, 2023

Deal Value: $10.8B

- In Apr 2023, Merck acquired Prometheus through a subsidiary as a move to accelerate its position in the Immunology sector.

- This transaction to allow Merck to gain rights for Prometheus' assets including

- P-II PRA-023 for Ulcerative Colitis and Crohn's Disease,

- P-I PRA-052, Preclinical PR-1100, PR-2100,

- PR-300 for Immune-Mediated Diseases,

- Prometheus360 Technology Platform

- As per the terms of the acquisition agreement, Prometheus was acquired for $200.00 per share in cash at a 75% one-day premium adding to a total equity value of ~$10.8B. Later, on June 16, 2023, Merck completed the acquisition of Prometheus

2. BMS and Karuna Therapeutics

Deal Date: Dec 22, 2023

Deal Value: $14B

- BMS reported the acquisition of Karuna by the end of Dec 2023. The decision was made by BMS to bolster its neuroscience portfolio.

- This acquisition grants BMS the rights to Karuna’s lead neuroscience assets incl.

- KarXT, an antipsychotic drug. KarXT (xanomeline-trospium) is an M1/M4 muscarinic receptor agonist antipsychotic developed for adults with schizophrenia

- Under the terms of the acquisition agreement, BMS to acquire all outstanding shares of Karuna’s common stock for $300 per share in cash at a 53% one-day premium adding to a total equity value of $14B, or $12.7B net of estimated cash acquired. The transaction is expected to close by the first half of 2024

1. Pfizer and Seagen

Deal Date: Mar 12, 2023

Deal Value: $43B

- In Mar 2023, Pfizer signed a merger agreement to acquire Seagen for its ADC technology. The acquisition was made for strengthening Pfizer’s capabilities and expertise in Oncology. The acquisition includes Seagen’s lead oncology assets and clinical programs

- Adcetris for B-Cell and Hodgkin Lymphoma

- Padcev for Solid Tumors

- Tivdak for Urothelial CarcinomaDisitamab Vedotin for Cervical Cancer, and Tukysa for Breast Cancer

- P-II Ladiratuzumab vedotin for Breast Cancer, Head & Neck Cancer, and Non-Small Cell Lung Cancer

- P-I SEA-CD70 for Acute Myeloid Leukemia

- P-I SEA-TGT, SGN-B6A, SGN-STNV, SGN-B7H4V, SGN-PDL1V, SGN-ALPV, and SGN-BB228 for Solid Tumors

- ADC and Sugar-Engineered Antibody (SEA) Technologies

- As per the agreement, Seagen stakeholders received $229 per share in cash at a 32.7% one-day premium summing the total deal value to an aggregate of $43B. On Dec 14, 2023, Pfizer completed the acquisition of Seagen

Related Posts: Top 20 Biopharma M&A of 2022 by Total Deal Value

Tags

Shivani is a content writer at PharmaShots. She has a keen interest in recent innovations in the life sciences industry. She covers news related to Product approvals, clinical trial results, and updates. She can be contacted at connect@pharmashots.com.